Investing in Mexico’s real estate market can be a great opportunity for Americans, but it’s essential to understand the property tax laws and implications that come with it. Whether you are looking to buy a vacation home or a rental property, knowing the Mexican tax landscape will help you avoid an unexpected payment or legal issues. This guide aims to simplify property taxes in Mexico and fees for American landlords.

Eligibility Criteria for Mexican Residency and Taxation

Understanding the eligibility criteria for Mexican residency and how it affects taxation is important. If you own real estate, you may be subject to property taxes in Mexico regardless of your residency status, but the rules differ based on whether you are a resident or a non-resident.

- Residency – Mexican residents are subject to pay property taxes on all their global income, while non-residents are only taxed on income generated within Mexico.

- Non-Residents – If you do not have Mexican residency but own residential property, you are still must pay property-related taxes. For example, non-residents may face withholding taxes when selling property or earning income.

Overview of Taxes in Mexico

Whether you buy, rent out, or sell real estate in Mexico, you will encounter several kinds of property taxes, some similar to those in the United States. Understanding the Mexico property taxes will help you plan your investment and avoid an unexpected payment.

- Property Acquisition Tax – The acquisition tax is paid when you purchase real estate in Mexico. The payment rate varies by region but typically ranges from 2% to 4% of the property’s value.

- Property Taxes – These are annual property taxes paid to the local government based on the assessed value of your property.

- Capital Gains Tax – If you sell your property for a profit, you may be subject to a capital gains tax, generally 35% for non-residents and 30% for residents. However, certain exemptions or deductions may apply if the property has been your primary residence.

Comparison of Tax Rates: Mexico vs. the United States

A major question for American investors is how tax rates compare to those in the United States. While property taxes in Mexico are generally lower than those in the U.S., other taxes. Although property tax rates in Mexico are lower, capital gains and acquisition taxes can be higher, particularly for non-residents. It’s important to take these costs into account when planning your investment.

Tax Filing and Forms for U.S. Expats in Mexico

American landlords with property in Mexico must comply with Mexican and U.S. tax filing requirements. The IRS still expects you to report worldwide income, which includes income earned from Mexican properties through rent payments. When it comes to tax filing, American property owners should be aware of the following:

- Form 1040 – You will still file a regular U.S. tax return (Form 1040), reporting income from all sources, including rental income from Mexico.

- Form 1116 – To avoid double taxation, you may claim a Foreign Tax Credit using Form 1116, which allows you to deduct or receive credit for taxes paid to Mexico.

- Form 8938 – If your foreign assets exceed certain thresholds, you may need to file Form 8938 to report these holdings to the IRS.

- Tax Filings – In Mexico, you may also need to file annual property tax returns for income and other earnings.

Types of Income and Tax Implications in Mexico

The type of income you earn affects how you are taxed under Mexican law. Below are the main types of income and their tax implications:

- Rental Income – If you rent out your property in Mexico, you are required to pay income tax on the rental income. The rate you pay is generally between 15% and 30% for residents and can be withheld at source for non-residents.

- Capital Gains Taxes from Property Sales – As mentioned earlier, capital gains tax is applicable when you sell your property at a profit.

- Other Income – If you generate other types of income in Mexico, such as income from services, you may need to report and pay taxes in Mexico on that as well.

Social Security and Pension Systems in Mexico

Although unrelated to property taxes, American real estate investment owners living in Mexico often inquire about social security and pensions. The U.S.-Mexico Totalization Agreement allows Americans to avoid double social security taxation. It also ensures that the time worked in both countries can count toward benefits.

If you receive U.S. social security or pension benefits, they are generally not taxable in Mexico under the U.S.-Mexico Tax Treaty. However, it’s essential to report these earnings in the U.S., even if it’s not taxable in Mexico.

Tax Deductions and Credits for U.S. Expats in Mexico

One of the main ways to reduce your overall tax liability is through tax deductions and credits. The Foreign Tax Credit and the Foreign Earned Income Exclusion are two key tools for U.S. ex-pats to reduce their U.S. tax burden:

- Foreign Tax Credit – This allows you to offset taxes paid to Mexico against your U.S. tax liability.

- Foreign Earned Income Exclusion – If you meet the residency or physical presence test, you may be able to exclude a certain amount of foreign-earned wealth from your U.S. taxes.

The U.S.-Mexico Tax Treaty: What You Need to Know

The treaty is designed to avoid double taxation and reduce the tax burden on property owners, individuals, and businesses operating in both countries. For American investors, the treaty allows for certain generated wealth, such as social security benefits, to be taxed only in the U.S. rather than in both countries.

Bottom Line

Understanding property taxes in Mexico is crucial for American investors looking to buy and manage rental properties. Seek advice from a tax professional who understands U.S. and Mexican tax laws to ensure compliance and maximize the treaty benefits.

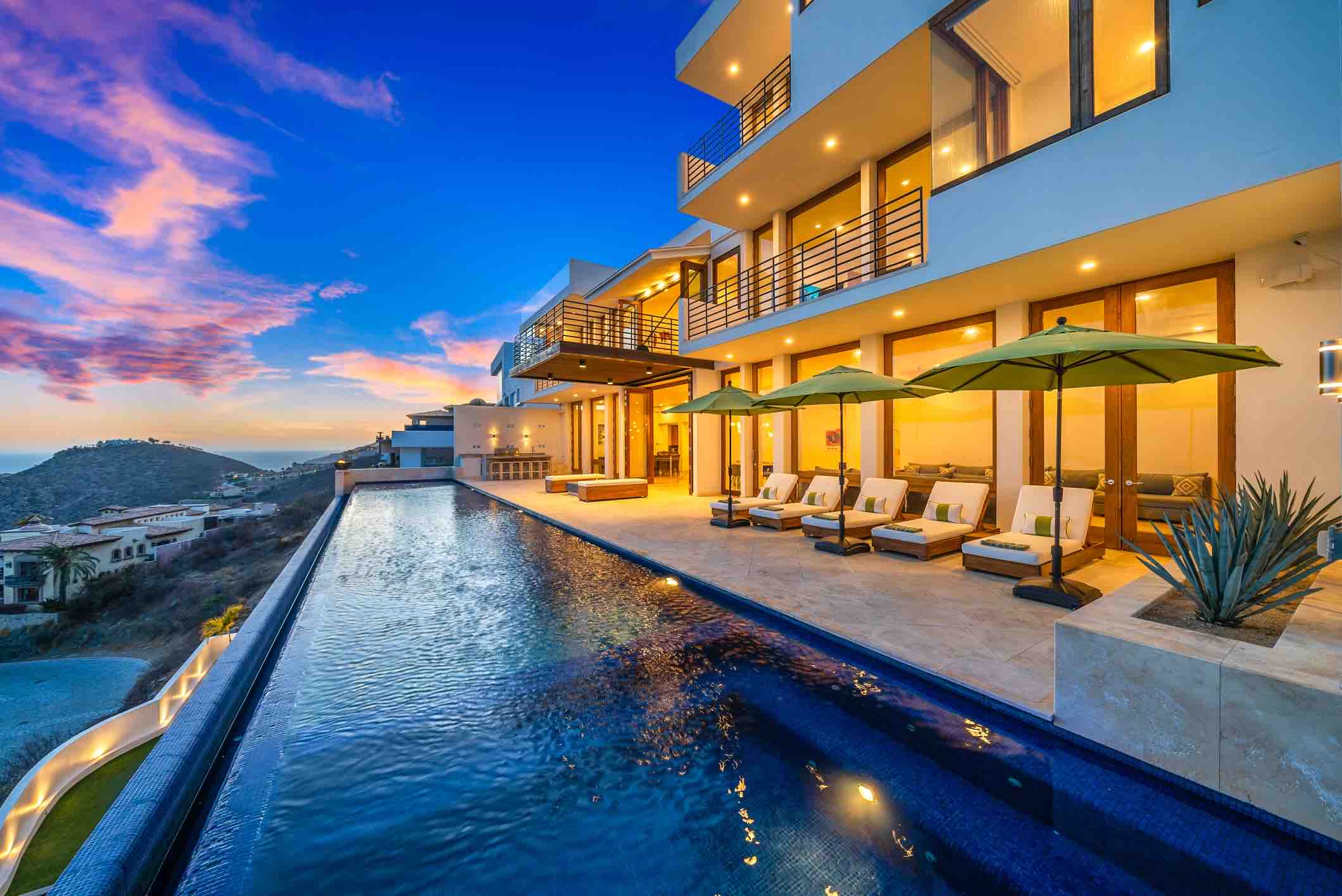

If you’re an American landlord interested in Mexican property, Vacation Los Cabos can help guide you. Our experienced team is well-versed in the both tax systems and can assist with everything from property acquisition to tax planning. Contact us today to learn the benefits of having us as your property manager and experience stress-free property ownership!